Some Things Don't Change in Grover's Corners

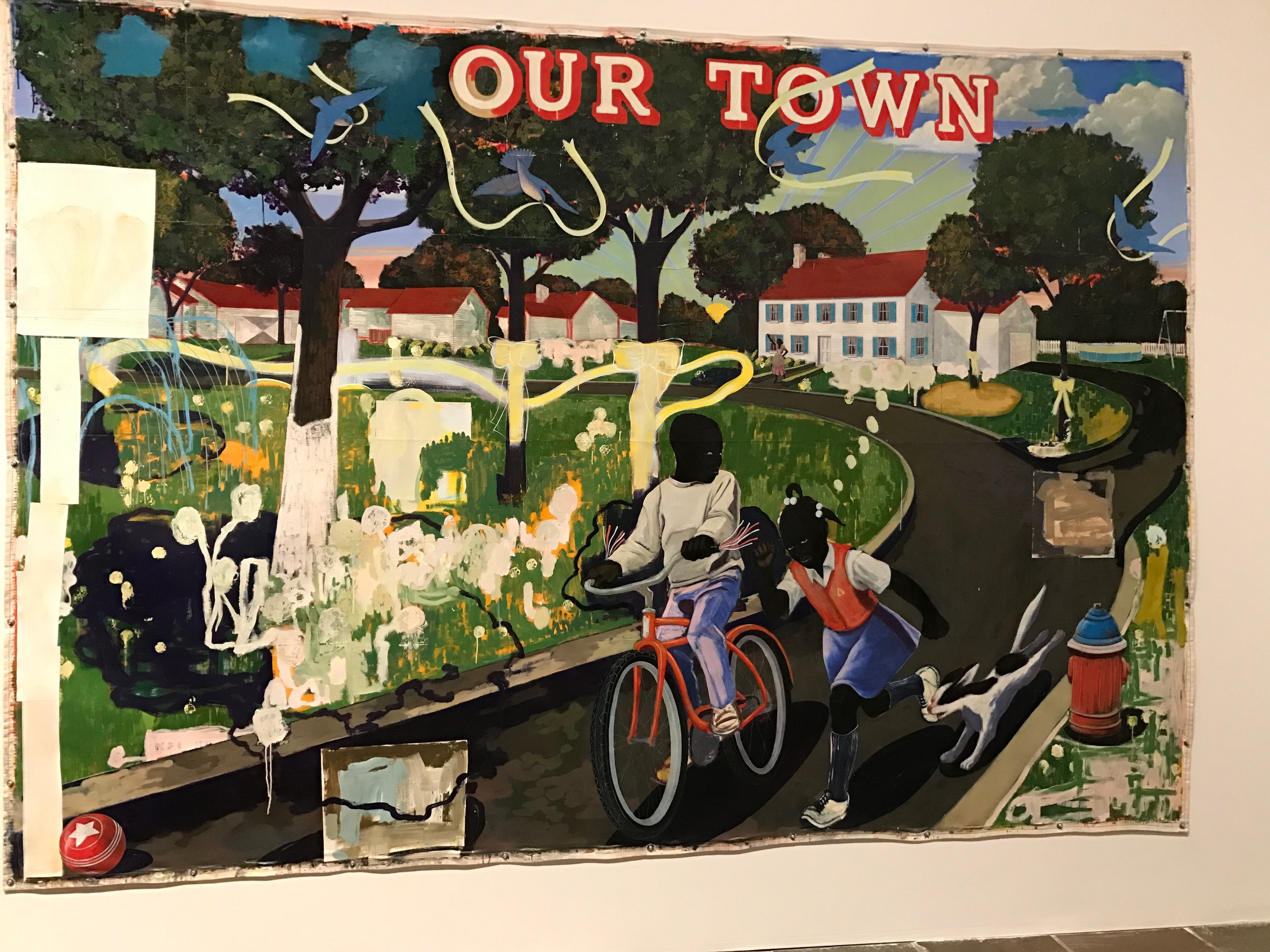

Our Town (1995) by Kerry James Marshall, as seen in The Met Breuer’s exhibition Mastry (October 25, 2016 - January 29, 2017)

This piece appeared in The New York Times on March 7, 2009

SOME THINGS DON’T CHANGE IN GROVERS CORNERS by FRANK RICH

“WHEREVER you come near the human race, there’s layers and layers of nonsense,” says the Stage Manager in Thornton Wilder’s “Our Town.” Those words were first heard by New York audiences in February 1938, as America continued to reel from hard times. The Times’s front page told of 100,000 auto workers protesting layoffs in Detroit and of a Republican official attacking the New Deal as “fascist.” Though no one was buying cars, F.D.R. had the gall to endorse a mammoth transcontinental highway construction program to put men back to work.

In the 71 years since, Wilder’s drama has become a permanent yet often dormant fixture in our culture, like the breakfront that’s been in the dining room so long you stopped noticing its contents. Requiring no scenery and many players, “Our Town” is the perennial go-to “High School Play.” But according to A. Tappan Wilder, the playwright’s nephew and literary executor, professional productions have doubled since 2005, including two separate hit revivals newly opened in Chicago and New York.

You can see why there’s a spike in the “Our Town” market. Once again its astringent distillation of life and death in the fictional early-20th-century town of Grover’s Corners, N.H., is desperately needed to help strip away “layers and layers of nonsense” so Americans can remember who we are — and how lost we got in the boom before our bust.

At the director David Cromer’s shattering rendition of the play now running in Greenwich Village, it’s impossible not to be moved by that Act III passage where the Stage Manager comes upon the graves of Civil War veterans in the town cemetery. “New Hampshire boys,” he says, “had a notion that the Union ought to be kept together, though they’d never seen more than 50 miles of it themselves. All they knew was the name, friends — the United States of America. The United States of America. And they went and died about it.”

Wilder was not a nostalgic, sentimental or jingoistic writer. Grover’s Corners isn’t populated by saints but by regular people, some frivolous and some ignorant and at least one suicidal. But when the narrator evokes a common national good and purpose — unfurling our country’s full name in the rhetorical manner also favored by our current president — you feel the graveyard’s chill wind. It’s a trace memory of an American faith we soiled and buried with all our own nonsense in the first decade of our new century.

Retrieving that faith now requires extraordinary patience and optimism. We’re still working our way through the aftershocks of the orgy of irresponsibility and greed that brought America to this nadir. In his recent letter to shareholders, a chastened Warren Buffett likened our financial institutions’ recklessness to venereal disease. Even the innocent were infected because “it’s not just whom you sleep with” but also “whom they” — unnamed huge financial institutions — “are sleeping with,” he wrote. Indeed, our government is in the morally untenable position of rewarding the most promiscuous carrier of them all, A.I.G., with as much as $180 billion in taxpayers’ cash transfusions (so far) precisely because it can’t be disentangled from all the careless (and unidentified) trading partners sharing its infection.

Buffett’s sermon coincided with the public soul searching of another national sage, Elie Wiesel, who joined a Portfolio magazine panel discussion on Bernie Madoff. Some $37 million of Wiesel’s charitable foundation and personal wealth vanished in Madoff’s Ponzi scheme. “We gave him everything,” Wiesel told the audience. “We thought he was God.”

How did reality become so warped that Wiesel, let alone thousands of lesser mortals, could mistake Madoff for God? It was this crook’s ability to pass for a deity that allowed his fraud to escape scrutiny not just from his victims but from the S.E.C. and the “money managers” who pimped his wares. This aura of godliness also shielded the “legal” Madoffs at firms like Citibank and Goldman Sachs. They spread V.D. with esoteric derivatives, then hedged their wild gambles with A.I.G. “insurance” (credit-default swaps) that proved to be the most porous prophylactics in the history of finance.

The simplest explanation for why America’s reality got so distorted is the economic imbalance that Barack Obama now wants to remedy with policies that his critics deride as “socialist” (“fascist” can’t be far behind): the obscene widening of income inequality between the very rich and everyone else since the 1970s. “There is something wrong when we allow the playing field to be tilted so far in the favor of so few,” the president said in his budget message. He was calling for fundamental fairness, not class warfare. America hasn’t seen such gaping inequality since the Gilded Age and 1920s boom that preceded the Great Depression.

This inequity was compounded by Bush tax policy and by lawmakers and regulators of both parties who enabled and protected the banking scam artists who fled with their bonuses and left us holding the toxic remains. The fantasy of easy money at the top of the economic pyramid trickled down to the masses, who piled up debt by leveraging their homes much as their ’20s predecessors once floated stock purchases “on margin.” Our culture, meanwhile, painted halos over celebrity C.E.O.’s, turning the fundamentalist gospel of the market into a national religion that further accelerated the country’s wholesale flight from reality.

The once-lionized lifestyles of the rich and infamous were appallingly tacky. John Thain’s parchment trash can was merely the tip of the kitschy iceberg. The level of taste flaunted by America’s upper caste at the bubble’s height had less in common with the Medicis than, say, Uday and Qusay Hussein.

The cultural crash should have been a tip-off to the economic crash to come. Paul Greenwood and Stephen Walsh, money managers whose alleged $667 million fraud looted the endowments at the University of Pittsburgh and Carnegie Mellon, were fond of collecting Steiff stuffed animals, including an $80,000 teddy bear. Sir Robert Allen Stanford — a Texan who purchased that “Sir” by greasing palms in Antigua — poured some of his alleged $8 billion in ill-gotten gains into a castle, complete with moat, man-made cliff and pub. He later demolished it, no doubt out of boredom.

In a class apart is the genteel Walter Noel, whose family-staffed Fairfield Greenwich Group fed some $7 billion into Madoff’s maw. The Noels promoted themselves, their business and their countless homes by posing for Town & Country. Their firm took in at least $500 million in fees (since 2003 alone) for delivering sheep to the Madoff slaughterhouse. In exchange, Fairfield Greenwich claimed to apply “due diligence” to every portfolio transaction — though we now know Madoff didn’t actually trade a single stock or bond listed in his statements for at least the past 13 years.

But in the bubble culture, money ennobled absolutely. A former Wall Street executive vouched for his pal Noel to The Times: “He’s a terribly good person, almost in the sense of Jimmy Stewart in ‘It’s a Wonderful Life’ combined with an overtone of Gregory Peck in ‘To Kill a Mockingbird.’ ”

Last week Jon Stewart whipped up a well-earned frenzy with an eight-minute “Daily Show” takedown of the stars of CNBC, the business network that venerated our financial gods, plugged their stocks and hyped the bubble’s reckless delusions. (Just as it had in the dot-com bubble.) Stewart’s horrifying clip reel featured Jim Cramer reassuring views that Bear Stearns was “not in trouble” just six days before its March 2008 collapse; Charlie Gasparino lip-syncing A.I.G.’s claim that its subprime losses were “very manageable” in December 2007; and Larry Kudlow declaring last April that “the worst of this subprime business is over.” The coup de grâce was a CNBC interviewer fawning over the lordly Robert Allen Stanford. Stewart spoke for many when he concluded, “Between the two of them I can’t decide which one of these guys I’d rather see in jail.”

Led by Cramer and Kudlow, the CNBC carnival barkers are now, without any irony whatsoever, assailing the president as a radical saboteur of capitalism. It’s particularly rich to hear Cramer tar Obama (or anyone else) for “wealth destruction” when he followed up his bum steer to viewers on Bear Stearns with oleaginous on-camera salesmanship for Wachovia and its brilliant chief executive, a Cramer friend and former boss, just two weeks before it, too, collapsed. What should really terrify the White House is that Cramer last month gave a big thumbs-up to Timothy Geithner’s bank-rescue plan.

In one way, though, the remaining vestiges of the past decade’s excesses, whether they live on in the shouted sophistry of CNBC or in the ashes of Stanford’s castle, are useful. Seen in the cold light of our long hangover, they remind us that it was the America of the bubble that was aberrant and perverse, creating a new normal that wasn’t normal at all.

The true American faith endures in “Our Town.” The key word in its title is the collective “our,” just as “united” is the resonant note hit by the new president when saying the full name of the country. The notion that Americans must all rise and fall together is the ideal we still yearn to reclaim, and that a majority voted for in November. But how we get there from this economic graveyard is a challenge rapidly rivaling the one that faced Wilder’s audience in that dark late winter of 1938.